Tax Free Childcare

The Tax-Free Childcare scheme is a UK government initiative designed to help working parents with the cost of childcare. As a nanny, it's important to understand how it works because it can be a deciding factor for some families when hiring a nanny.

Here's what you need to know:

Eligibility: The scheme is available to parents of children up to the age of 11 (inclusive), or 16 if the child is disabled. Both parents must be working for 16 hours a week on average, and not individually earn more than £100,000 each per year.

How it Works: For every £8 parents pay into an online account, the government will add an extra £2, up to £2,000 per child per year (or £4,000 for disabled children). Parents can then use this money to pay for approved childcare, which includes registered nannies.

Registration: To be able to accept payments through the Tax-Free Childcare scheme, you as a nanny need to be registered with a relevant regulatory body and sign up for the scheme. You'll get a unique childcare provider reference number, which parents will use to make payments to you through the scheme.

Payments: Once you're registered, parents can pay you directly from their Tax-Free Childcare account. It's important to keep records of these payments and include them in your income for tax purposes.

Nannies in England will need to be registered on the OFSTED Voulantry Childcare Register (OVCR); in Scotland registration is required with the Scottish Care Inspectorate; in Wales registration is required through Care Instecotrate Wales; and in Northern Ireland through the local early years team.

How do you register with the Tax-Free Childcare Scheme to recieve payments?

You should have recieved a user ID in the post to the address registered with the relevant childcare regulator.

If you have not recieved this then call the Childcare Services Helpdesk at HMRC on 0300 123 4097 to check the registered address.

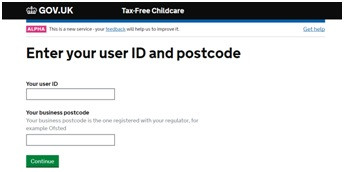

Once you have your user ID you need to follow the online sign up system which can be found here.

Enter your user ID and postcode.

Enter the ‘user ID’ and ‘postcode’ as it is shown on your invitation letter. Your business postcode is your home location.

The system will lookup your details and ask you to confirm that they are correct.

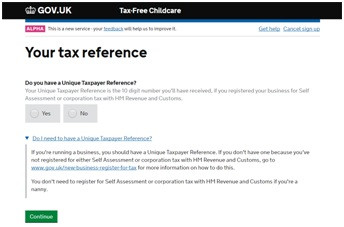

Do you have a Unique Taxpayer Reference?

As a nanny you will not have a taxpayer reference unless you have previously or are currently also running your own business.

Most nannies will select ‘No’.

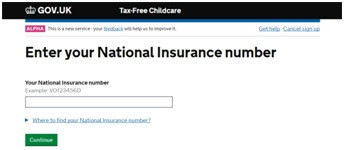

Enter National Insurance number.

Enter your National Insurance number.

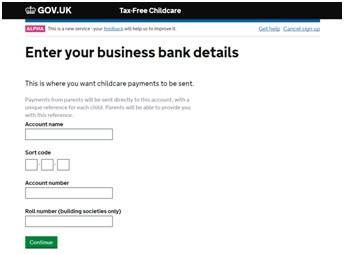

Enter your business bank details.

Enter the bank account details for where you wish to be paid by your employer. This will typically be your bank current account, you do not need to have a specific business bank account.

Leave the ‘Roll Number’ field empty unless you bank with a building society and have a roll number.

Check your bank details are correct otherwise someone else will get your pay!

Do you want to nominate a delegate?

A delegate is someone to assist you with using the online system and therefore your answer will generally be ‘No’.

If you are visually impaired and need assistance then you may have someone assisting you.

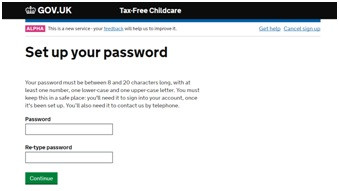

Enter the password you would like to use.

Your password must be 8 to 20 characters and contain at least one number, one lower-case and one upper-case letter.

The system will now take you through a process of setting security questions. When you login or phone the helpline, you will be asked for various details from your security questions to confirm that you are authorised to access your account.

How Payment Works

Parents have one Tax-Free Childcare account per child. When a parent pays you, they will transfer payment to their Tax-Free Childcare Account and within three to four days your net pay will arrive in your nominated bank account. If they have more than one child you may receive several payments, this is absolutely normal. Each payment will have a reference to help you to identify for which child the payment relates.

Parents may not be aware that there is a delay from when they transfer the money into their Tax-Free Childcare account and when you receive that money, so it may be helpful for you to let them know if your payments arrive late.

Useful Websites and Phone Numbers

Tax-Free Childcare helpline - 0300 123 4097

Childcare Choices – Government micro-site providing information to parents about various childcare schemes

Childcare Calculator – A calculator to help parents determine which childcare scheme is best given their personal circumstances